Jeffrey Gundlach is the founder of DoubleLine Capital, an employee-owned investment management firm headquartered in Tampa, Florida. They primarily manage bonds but also lesser modest allocations to equities and commodities. He has been referred to in the past as "The King of Bonds," taking that honor away from former PIMCO fund manager Bill Gross.

I recently watched a podcast where Gundlach walked the audience through a chart-laden analysis of the outlook for GDP, inflation, deficits, and bond yields, concluding that the most dangerous time for the economy is when yields begin to decline after an extended period of monetary tightening. The quote shown above is quite timely in that the iShares 20+ Year Treasury Bond ETF (TLT:US), which I picked off at the lows back in October, has advanced 21.94% in sixty days.

The U.S. 10-year yield has plunged from over 5% in October to under 4% here in December, so that "fire alarm" referred to by Gundlach has definitely started to blare. . .

The Shadow

"The Shadow" is a fictional character created by Walter B. Gibson, one of the most famous of the pulp heroes of the 1930s and 1940s. The famous radio program from that era started with the question shown in the graphic and is answered with "Only the SHADOW knows," followed by eerie chamber music and creepy sounds.

As I was listening to Fed Chairman Jerome Powell doing his finest impersonation of Alan Greenspan, with incoherent and unconnected references to "dot plots" and "core PPI" and repeated vows to "do the right thing" and "avoid overtightening," I was reminded of that opening line that in 2023 might have read "Who knows what evil lurk in the hearts of men? Only the Fed chairman knows."

I ask you all to take the time to read the words of a septuagenarian scribe who has been navigating markets for over 45 years to ask yourself, "Is ANYTHING that comes out of a central banker's mouth EVER be seen as honest?" How can a man empowered by an agency (the Fed) owned by a consortium of banks whose mandate is to "preserve the solvency of the U.S. Treasury" ever be expected to act in the sincere interests of the average investor, let alone the average citizen?

Powell told the world for two years that a "2% CPI mandate" was his avowed target, and then, with streaking stock and bond markets and the CPI's latest uptick at 3.1%, he just told the world that policy was no longer "higher for longer" but instead "Biden for longer" and stocks exploded to the upside. These actions are not those of a dedicated public servant but rather a dedicated political servant using tactics only two well-known over the years.

The former Fed Chairman, Benjamin Shalom Bernanke, an academic master who received a Ph.D. in economics from the Massachusetts Institute of Technology in 1979 with his thesis detailing the causes and effects of the Great Depression, told Congressman Ron Paul back in February of 2012 that the Federal Reserve "does not print money." To the extent that the actual manufacturing of the U.S. currency is the role of the United States Mint and not technically the Fed, one would have to admit that Bernanke was being truthful.

However, if the question had been rephrased as "Can you instruct the U.S. Mint to print money?" the answer would have been "yes" by default. If the Fed lends $1 billion to the U.S. Treasury through its member banks and the Treasury helicopter drops that mount directly to citizens as happened during the pandemic in 2020, those citizens can request cash from the receiving bank with the bank obligated to provide it.

Nice, crisp, $100 Franklins, fresh from the U.S. Mint, floating around the financial system in an endless quest for "stuff" designed to keep the economy from imploding after politicians shut the world down to fight a nasty flu bug.

No incumbent president since George H.W. Bush in 1992 has forgotten the famous campaign slogan designed by strategist James Carville that read, "It's the economy, stupid!" that was largely cited as the major reason that Bill Clinton won the presidency that year.

For the last 30 years, incumbents have stepped up pressure in the election year for the Fed to ease credit conditions in order to mollify the voters. Whether it was Bush Jr. or Barack Obama or Donald Trump, they all go very public with their remarks regarding Fed policy, while the Fed Chairman, whether it be Greenspan or Bernanke or Yellen, all stick to the well-scripted party line that "The Fed is an independent body immune from partisan pressures."

In election years where the economy is sluggish, the wailing and whining from the White House reaches feverish crescendos with the inevitable accommodation by the Fed, but not before two dozen press conferences in which they restate their "independence."

Stocks

So, with all leading economic indicators spelling recession while being challenged by recent advances in CPI and PPI, the Battle Against Inflation declared by Powell in 2022 after deeming it innocuously "transitory" in 2021 has been declared over sending stock and bond prices into a parabolic ascent last week as widespread euphoria sent everything into a vertical ejaculation of lustful greed.

You will forgive the expression, but the phrase "blow-off top" keeps resonating around the annals of stock market muscle memory. The Dow Jones Industrial Index is cruising along at record highs, with the S&P 500 about 20 points from its 52-week high and about 100 points from its all-time high at 4,818.

The Invesco QQQ ETF (QQQ:NASDAQ) (a proxy for the tech sector/NASDAQ) is about 3 points from its 52-week high, having traded up to an all-time high of 406.30 yesterday. Dow Theory dictates that any new high in the Dow must be accompanied by a corresponding new high in the Transportation Average ("DJTA" in order for the Dow's move to be justified. In economics, it meant that while industrial production gets reported at a new high level, the movement of those goods by rail, sea, or air confirms that they were sold and en route to the buyers.

If the transports fail to confirm, then the goods are sitting as "unsold inventory," which obviously hurts profits, thus creating a "non-confirmation." The 52-week high for the "Trannies" is 16,717 versus the weekly close at 16,016, so that represents a pretty tall order for them to confirm any time soon. It is seen as "antiquated" for many of the modern, younger market gurus that move the tea leaves around, but for me, it is another useful tool to try to handicap the next major move for equities. The creators of Dow Theory never established a time frame after which they declared a non-confirmation, but the late, great Richard Russell would only say "within a reasonable period."

Fear and Greed

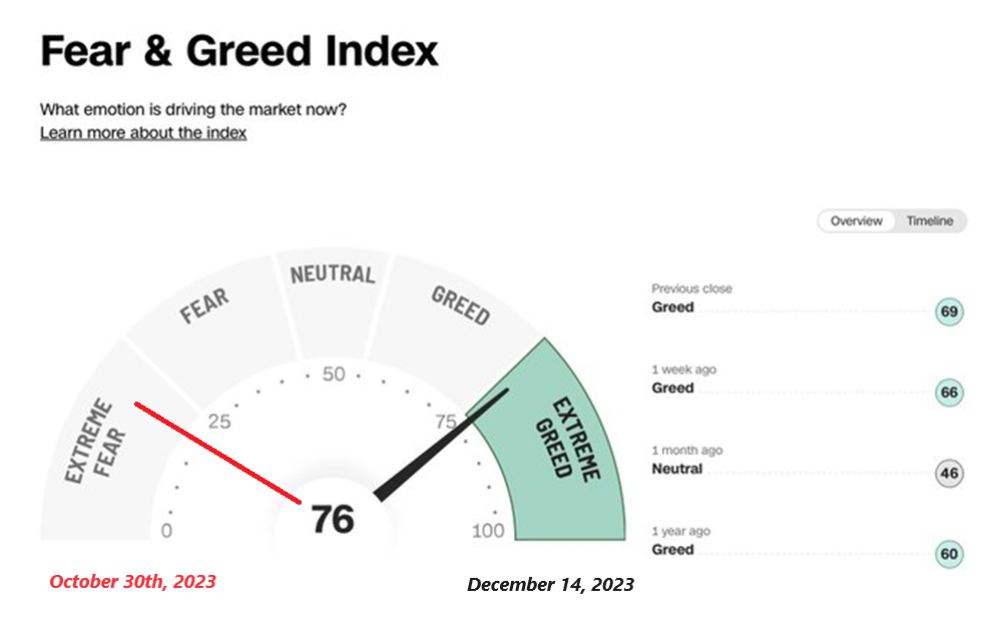

I also take note of the CNBC Fear and Greed Index, which I included here in late October when it was registering a 20 reading or <EXTREME FEAR>, representing one of the indicators I used to nail the bottom.

During topping phases in other eras, this indicator could get into the mid-to-high 90s before markets reversed, so as I have written about so many times over the years when markets (either bull or bear) move from "gradual" to "vertical," you know the end is coming.

Stated another way, 90% of the price move found on the X-axis is usually found in the last 10% of the time on the Y-axis. That is where we are. . .

Gold

Settling the week roughly $120 per ounce off the blow-off top established during the December 3-4 carpet bombing episode that magically occurred a mere ten days before the Fed "pivot." I am absolutely 100% certain that it was a mere coincidence that gold was prevented from "sniffing out" the pivot as it most certainly was that Sunday evening.

After all, the Fed would not be concerned about an exploding gold price if they were planning a major shift in policy that could only be seen as "inflationary," now, would they?

Of course, you will all forgive the sarcasm here, but one would have to be senile to view the events in the precious metals this month as "random movements in free market capitalism."

As a worshipper of ex-Fed Chairman Paul Volcker, Powell can recite, chapter and verse," the parts of Volcker's memoirs where it explains how "the only mistake I made during my tenure as Chairman was to fail to control the gold price."

Between the ammunition banks of bullion manipulators in full employ of the N.Y. Fed, and with the blessing and backing of the Treasury and SEC, gold went out for the week in which the Fed pivoted up 3.79% for the year versus the Dow Jones' 15.13% moonshot in 2023.

Mission accomplished, no?

Getchell Gold

I have no trading positions in gold at this time, and only if I see RSI under 30 for the SPDR Gold Shares ETF (GLD:NYSE) will I even vaguely entertain a position. I have more than enough physical metal and a whopping position in Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), down 75% YTD and trading at a level where their 2,059,000 ounces of gold in Nevada are being priced at $4.90/ounce per Getchell share.

If and when next month they make their final $1.6mm payment and secure 100% interest in the Fondaway Canyon property, I am pretty sure that markets will wake up and revalue the asset to somewhere north of $50/ounce.

However, it will probably demand new highs in gold above $2,150 in order to peak investor interest, although volume last week started to flow back in.

Conclusion: GTCH/GGLDF represents an ideal leverage play on the price of gold.

Volt Lithium

Volt Lithium Corp. (VLT:TSV;VLTLF:US) announced the findings of Sproule Inc. in their Preliminary Economic Assessment.

Rainbow Lake PEA Highlights 1

- Production growing from 1,000 to over 23,000 metric tonnes per year (average over the years 5 to 19) of battery grade LHM 2 spanning a 19-year period;

- Pre-tax $1.5 Billion NPV at 8% discount rate (" NPV 8 ") and IRR of 45%;

- After-tax $1.1 Billion NPV 8 and IRR of 35%;

- Volt has entered into a capital expenditure recovery program and cost-sharing arrangement with a private oil and gas company (the " E&PCo "), which is expected to allow Volt to significantly enhance overall project economics 3 ;

- OPEX of approximately $3,276/tonne LHM in the Muskeg formation, with an average grade of 92 mg/L, and approximately $4,545/tonne in the Keg River formation, with an average grade of 49 mg/L; and

- Project economics assumed $25,000/tonne LHM and provided strong leverage to higher lithium prices.

Had Volt come with these results in September, as indicated last May, the response in the market would have been substantially better than this week's response. Lithium prices have retreated sharply since September, and the junior lithium space has responded accordingly.

The results, nevertheless, were impressive, at least on paper.

However, the major headwind for all lithium deals is seen in the chart below.

The big change since I first mentioned this name, outside of the crashing lithium price, is the most recent outlook provided by Trading Economics:

"EV sales pessimism in China limited lithium demand for battery manufacturers in their typical restocking season. Instead, firms took advantage of high inventories following the supply glut caused by extensive subsidies from the Chinese government throughout 2021 and 2022. These developments drove key market players to forecast the next lithium deficit to return only in 2028, an aggressive twist from speculations of persistent shortfalls that took lithium prices to CNY 600,000 in November 2022."

Despite the possibility of no lithium deficit until 2028 being a major headwind, I continue to hold VLT/VLTLF on the assumption that if CEO Alex Wiley can execute, the stock will be a substantial outperformer.

Norseman Silver

Norseman Silver Inc. (NOC:TSX.V; NOCSF:OTCQB): In the process of completing a CA$1.5mm raise (which should close before month-end)(email me at [email protected] if interested), tax-loss selling stragglers have been selling stock after seeing it gap up to CA$0.165 two short weeks ago after announcing the acquisition of the Caballos Copper Project in Chile.

I have spoken to V.P. Exploration Merlin Marr-Johnson in London about the deal, and any time a chap with Merlin's credentials opens with the phrase: "Go BIG or stay home," it immediately catches my attention.

Not to excessively pound tables on the topic, but 2024 is going to be the year that copper dominates the junior exploration and development space. Of all the shortages that have been bandied about since 2020, only uranium and copper have legs. Of the two, uranium juniors have had an excellent 2023 (as has my pick of Cameco Corp. (CCO:TSX; CCJ:NYSE) right after their last earnings report), but the copper juniors have not.

Well, perhaps that is not entirely true. A little penny dreadful called Hercules Silver Corp. (BIG:TSXV) was well ensconced in marketing their well-promoted Hercules Silver property while assuming that the #silversqueeze gang would be all over them when along came hole # HER-23-05 drilled to a depth below the known silver deposits and lo-and-behold, they hit 185 meters of .84% copper with 139 g/t silver and the stock exploded from $.20 to a high of $1.62.

A little firm called Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) bought a boatload of stock at CA$1.10 and today owns a notional 15.03% in the company.

Two things you can take to the bank: Barrick did not BIG for the silver, and Hercules Silver will soon have a name change to "Hercules Copper."

Copper in 2024. . .

| Want to be the first to know about interesting Cobalt / Lithium / Manganese, Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- [Norseman Silver Inc.] is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, [Volt Lithium Corp.] has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Norseman Silver Inc., Volt Lithium Corp., Cameco Corp., and Getchell Gold Corp.].

- [Michael Ballanger]: I, or members of my immediate household or family, own securities of: [All]. My company has a financial relationship with [Norseman Silver Inc.]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.